Basic Mortgage Qualification

Assuming you are in a good position to qualify for a mortgage (steady job, good credit & downpayment), figuring out how much you can qualify for is a pretty straightforward mathematical calculation. Although each lender has a unique way of qualifying a mortgage and there are multiple variations on each aspect of mortgage qualification, here are the basics.

To figure out how much of a mortgage you can qualify for, we compare your income to the cost of operating your home. This ratio is called a Gross Debt Service Ratio or GDS. In addition to the debt of your house, lenders like to look at any outside debts you may have such as car loans, student loans or credit card debt. When you add these debts to your GDS, you get your Total Debt Service Ratio or TDS.

For a CMHC insured mortgage - with a decent credit score, the acceptable GDS/TDS limit is 35% & 42% or with an excellent credit score you can stretch it out to 39% & 44%

The DNA of Your GDS

Your GDS is made up of the following (PITHC):

- (P) Principal repayment of the loan - You are borrowing money from the lender, you have to pay it back, this grows into home equity.

- (I) Interest charged for the loan - Again, you are borrowing money, this is the cost of borrowing as set by the interest rate.

- (T) Municipal Property Taxes - Traditionally substantiated through a municipal tax statement, MLS Listing or an appraisal.

- (H) Heat - It is cold in Canada - Heat is the one utility that you will always want to keep paid up to date, so they include it in mortgage qualification. Typically lenders use $100/mth as a base payment for heat.

- (C) Condo Fees - If you live in a property where there is a common cost such as a condo fee, it will be included in the mortgage calculation as it is a regular monthly expense.

Sample Mortgage Scenario

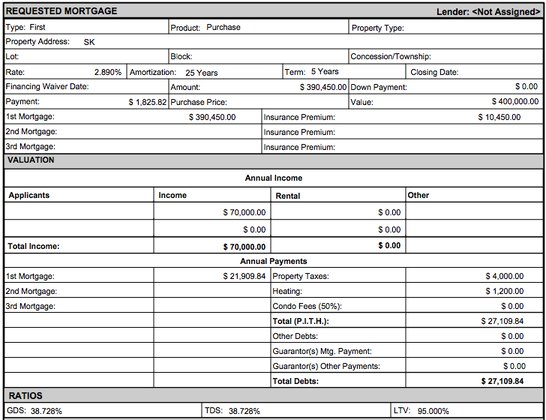

Let's say you are a permanent full time employee making a gross annual income of $70k. You have 5% saved up for a down payment on your first house, you have no debt and have immaculate credit (allowing you to go to a 39%GDS). You like the 5 yr fixed rate of 2.89% and want your payments to be as low as possible, so a 25 yr amortization is the way to go. Lets look at how you would qualify.

As you can see, the annual principal and interest payments are $21909.84, property taxes (estimated at 1% of property value) are $4000 annually with the heat at $1200 annually bringing the annual PITH to $27109.84. So to figure out the GDS ratio, we take the annual responsibility of $27109.84 and divide that by the annual income of $70000 to get 0.3872 or 38.72%. As 39% is the limit - this scenario is pushed to the max. However, within guidelines, you could qualify for a purchase price of $400k.

Typical Mortgage Scenario?

In the above scenario, I tried my best to simplify everything to illustrate exactly how the GDS works towards mortgage calculation. However from years of experience, I have come to one conclusion. There is nothing typical about any mortgage application! Mortgage qualification gets considerably more complicated when you introduce outside debts (which brings the TDS into play), have multiple applicants or co-signors, secondary or rental properties, rental income, are self-employed or using stated income, not to mention that each lender can possibly look at each of these things differently... you get the picture.

So, although you may only have a basic understanding of how mortgage qualification works, the good news: We know exactly how it works and we work for you!

Work with a Mortgage Professional

Mortgage qualification is what we do, we do it every day and we love it. We would love to represent you and make sure you get qualified for exactly what your income allows.

We work for you and not for the lender (that sounds so cliché, but it is so true).

Our services cost you nothing, so If you have any questions, contact us anytime, we would love to talk with you!

OWN. GROW. PROTECT. First Foundation is the one-stop-shop for financially responsible Canadians looking to get great advice and save money. Whether arranging financing for a property you OWN, or looking…