Go To Disney Land or Pay Bank Fees, Your Choice! | 52 Week Money Challenge

Okay, last week we talked about how the small things add up and how neglecting your automatic payments is a really bad idea. I want to expand on that idea a little bit as we are almost done transferring all our bank accounts to no fee banking. I knew we were paying for our banking, but I had no idea how several small amounts could add up so fast. It shouldn't come as a surprise, but it does. Up to this point, we have used 3 regular checking accounts and 2 credit cards for our daily banking needs.

- Conexus Checking Account $12/mth or $144/yr

- Conexus Joint Checking Account $12/mth or $144/yr

- TD Checking Account $18/mth or $216/yr

By switching our banking to no fee accounts we will save $504 not just once, but every year for the rest of our lives. Think about how much money that is!

Assuming you are paying roughly the same in bank fees as we were, if you simply switched to no fee banking and put the money aside in a no fee savings account, you could do the following...

- 1 year of savings $504 - A nice Family Weekend Getaway!

- 2 years of savings $1008 - Rent a Cabin for a week in summer holidays!

- 5 years of savings $2516 - You could drive across Canada... (good luck getting home)

- 10 years of savings $5032 - Family Vacation to Disney Land.

Now granted $5k might be a lean trip to visit Mickey and the bunch and 10 years is a long time to wait, but the fact is, even making the smallest changes to your spending habits can make a HUGE difference in the amount you can save. We are learning this first hand.

Getting Rid of Mint.com

I mentioned a couple weeks ago that Conexus Credit Union introduced a no-fee banking option. At the time, the awesome staff at Conexus changed over both our accounts saving us $288/year. This got me thinking... why were we banking with TD anyway? Oh ya, we opened a joint account with TD over a year ago because Conexus didn't connect to Mint.com and according to all the personal finance gurus, Mint.com is the only way to track your money (or so it seemed). Because TD was open late, we opened an account there.

For the last year we have been paying $18 a month to hook up to a system that doesn't work for us. We tried to organize our lives according to Mint however never really got the hang of it. We found that Mint didn't simplify our lives, it actually made it tougher to keep motivated. Our efforts increased as we had to recategorize line items, sync multiple accounts (credit cards), it wouldn't sync with our mortgage provider or car loan and at the end of the day we seemed to be classifying most of our spending as "other".

At the end of the day, it made no sense for us to be paying $216 a year for a "free service" that kept us from accomplishing our money goals.

No Fee Banking For The Win

So rather than keep our account with TD we switched everything to Conexus (so we can continue to deal with the great staff there) and opened a couple of TFSAs with ING Direct to house the money for our savings challenge. I don't know what it is about transferring the money out of the Conexus account to ING Direct but it feels like the money is gone... and I like that. Because the money isn't in our regular spending account, we don't have access to it. I like the separation caused by transferring from one institution to the other. Maybe it is just me, but our savings money feels untouchable. Untouchable, separated and not costing us a penny.

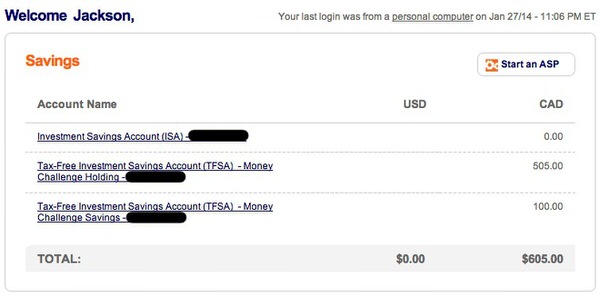

Bank Account Balance

As the goal with our 52 week money challenge is to figure out 52 unique ways to save or make money and record our progress from day 1, we have a little catching up to do. We are happy to report that we have transferred $100 into our savings TFSA and have a balance of $505 in our holding account.

Now here is how we got there!

Week 1 Freelance Work

A great way to make a little extra money is to hire yourself out. What are you good at, what specific skill do you have that you could use to make a little bit of money on the side?

Freelance work is a great way to put a little bit of cash into your savings account!

In my case, I play bass guitar and was asked to do some recording for my friend Angela Hutchison on her latest album project. Now, in no way was I expecting to get paid for the recording as I absolutely love playing, but nevertheless she sent me a money order for $100 in the mail so I had to cash it. Well, as it turned out, I got the letter just as we had to deposit $100 to open our ING Direct account. So Angela, although payment was completely unnecessary, it is certainly appreciated and was the first bit of money we saved in our challenge!

$100 in freelance work funded week 10 of the challenge.

Week 2 Open an ING Direct Account for Free Money

One of the reasons we chose to open our TFSA with ING Direct was the promise of free money. At the time, ING was offering a promotion where any new TFSA funded with $100 or more would receive a bonus of $25. In addition to that, I noticed on the personal finance blog Boomer & Echo that my buddy Robb Engen had an "Orange Code", and that if we used his Orange Code when opening the account, we would get an extra $25 added to our account.

By opening our TFSA with ING Direct we received $50 in free money... now, if only we were eating out, that would buy close to 3 restaurant lasagnas.

$50 in free money for opening a TFSA funded week 5 of the challenge.

Week 3 Cancelling Automatic Payments

As we shared last week in "Beware the Impact of Neglecting Your Automatic Payments" we were able to "not spend" over $1600 by simply evaluating what was coming out of our account on a monthly basis and cutting the excess. As a representation of this, we transferred $430 from our checking account to our savings account and will recoup the money as the year goes on.

$430 in money not spend on crap we didn't need funded week 43 of the challenge.

Week 4 Refer a Friend to ING Direct

Remember that Orange code Robb Engen had that we used to get $25 added in free money? Well... apparently ING gives everyone an Orange code. By simply referring friends to ING direct, they will fund $25 to your account and even have a bonus structure worked out. They will allow people to make up to $2000 in referrals. I have to say, this is a pretty good idea. My buddy Keith D Andrade wanted an account and used our Orange code and what do you know... 3 days later we got $25 deposited to our account. It actually works.

So here is the question, do we shamelessly push our Orange code on you and hope that you open an account to make us $25 richer? Normally, I would pass as I think the hard sell is kinda tacky, but hey... we are in a challenge and you have read this far. So...

- If you are looking for a great no-fee banking option,

- Want to get $25 for transferring $100 into a savings account,

- Want us to get $25 for to help fund our challenge,

then we would love to have you use our Orange code. However please don't feel any pressure to do so.

Our Orange Code is: 41233662S1

$25 in referral money funded week 2 of the challenge.

52 Week Money Challenge Template

We have been getting a lot of great feedback for this challenge, a lot of people have contacted us socially and told us that they are doing a money challenge as well. Some are doing the original at $1378 in 1 year, some are doing the challenge times 2, times 3 and even times 5. We are still working out the best format for a template. Please have a look at the one we have developed here (click on the link for a bigger version) and let us know what you think. Is it clear enough? What would you change?

I guess it does the trick for what we are doing, but if you have figured out something a little more simple and it is working for you, please consider sharing! We would love to hear from you!

Stay tuned next week as we share some stories about selling the crap in our basement! I think we will be able to make a lot of money there!

OWN. GROW. PROTECT. First Foundation is the one-stop-shop for financially responsible Canadians looking to get great advice and save money. Whether arranging financing for a property you OWN, or looking…