Vancouver, Toronto and OSFI - Oh My! - Survival Guide for Albertans

What are Edmontonians and Albertans Supposed to Think About Housing?

First things first: I like to repeat myself for effect sometimes, especially when it doesn't seem like what I'm saying is catching on. As a friendly reminder, THERE IS NO CANADIAN HOUSING MARKET. Housing markets are local, sometimes right down to the suburb or neighbourhood. When you think about it, the market often varies between Sherwood Park and Leduc, for example - so comparing Vancouver, Toronto, and the rest of the country is just ridiculous. There. I feel better.

So, that brings up the heading. What are we as #yeg folk supposed to think about our housing market? Is there a bubble? Is there too much supply? What about jobs - does anyone have one anymore? What are interest rates doing and why should I care? Who the heck is OSFI anyway?

Here's the Quick and Dirty Summary

(If you want more detail before you go chase Pokemon all over God's green earth then you can keep reading)

You should buy a home in Alberta now, because interest rates are low, home prices are lower or flat at best, inventory is high so you have lots to choose from, and eventually the bigger more overheated markets will need to take a break and investors will start to look for value plays. Especially if you still have a job.

There is little or no panicked buying so you can take your time and find the right home or investment for you. Realtors actually have (some) time to show you around. Everyone is trying harder to get you a good deal because everyone needs and wants more business.

Thanks to Toronto and Vancouver, it's also going to get harder to buy a home even though interest rates are low.

Am I biased because we are in the mortgage business? Yes.

Am I right? Yes.

Here are the Details (Or You Can Chase Pikachu Now)

- The media is focused on Toronto and Vancouver whose home values have been going up. A lot. Words like bubble, foreign ownership, shadow flipping, self-regulation, and supply constraints are flying around like gossip at the hair salon. In fact, there are even debates about why you can't compare the Vancouver and Toronto markets.

- In Edmonton, home sales are lower (PDF) and so is the real estate market in Calgary. The Edmonton Real Estate Blog reports a big dip in sales year over year for the beginning of July and hypothesizes that everyone is just on vacation. Let's hope so! Inventory is high and prices are flat.

- The unemployment rate in Alberta hasn't been this high since 1995. Our unemployment rate doesn't look so hot compared to the other provinces either. I know we should be shocked but...

...the Teranet and National Bank of Canada House Price Index released Wednesday, showed strong price growth in nine out of 11 markets. “That’s the story. Except for Calgary and Edmonton, and we know the economy is struggling there, June was above historical norms,” said Matthieu Arseneau senior economist with National Bank. - Financial Post

- The Bank of Canada cut its growth forecast and left its overnight rate at 0.5% - indicating that neither growth nor inflation pose a clear and present danger. Nice for borrowers. Bad for the country.

- Oil prices still stink even though it just went up by two bucks, and the glory days of oil and gas have yet to return even though the NDP is all of a sudden reducing royalty rates to encourage exploration and drilling.

- Probably the best news in a whole lot of ugly news is that mortgage rates are very low and look like they'll stay that way for awhile.

- OSFI, the government real estate nanny, is making all kinds of noise telling mortgage lenders that they really really should make sure that people qualify, or they'll really really do something about it. Really. They mean it this time. They haven't actually rolled out any new rules since B-20 and B-21, but they're sure serious. The more the media talks about this subject the more likely they are to change the rules for the 50th time in about 5 years.

What About Mortgage Rates?

- Global bond yields are down and some are even in negative territory - meaning that it'll cost you money over time to own bonds, instead of generating a return for you.

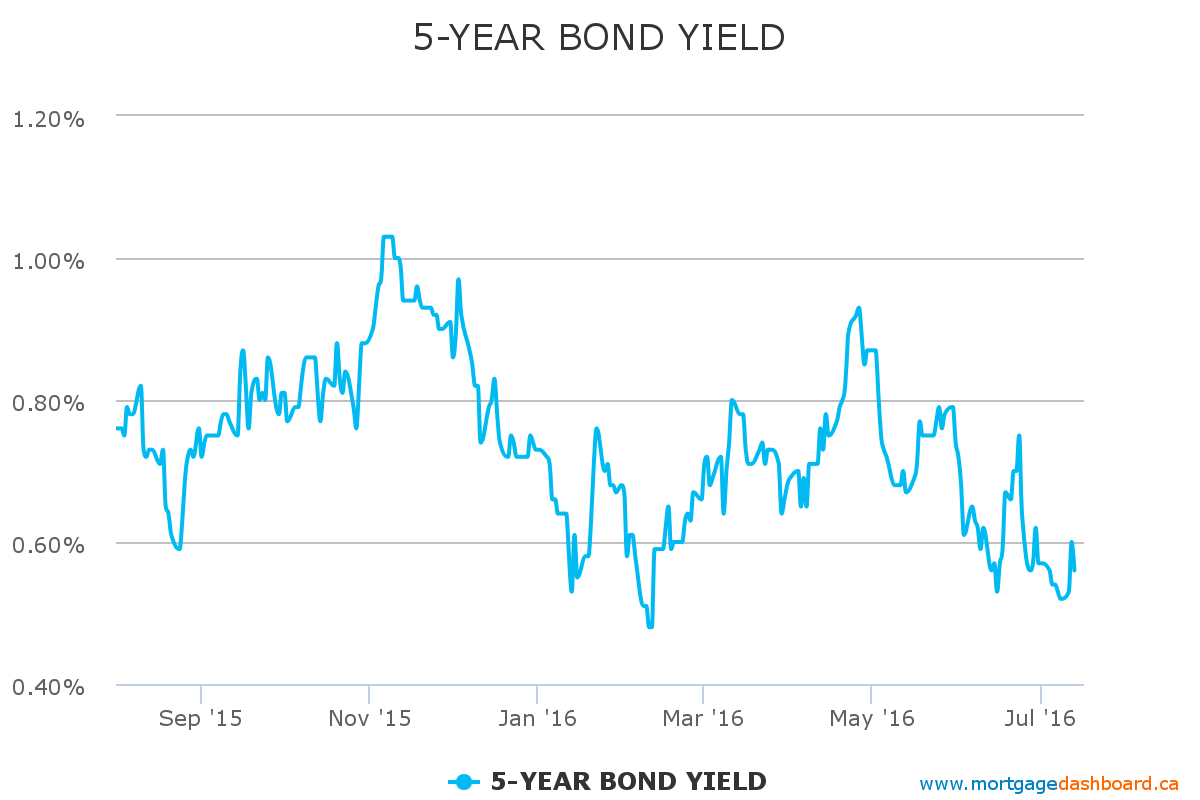

- This impacts fixed interest rates, which follow bond yields closely.

- Canadian yields look like this and our interest rates look a lot like this:

- Both fixed and variable mortgage rates are as low as ever and don't appear to be heading upwards. I think there's regulatory pressure on lenders not to go below some sort of "floor" rate which could add fuel to the fire.

What's Going on With the Regulatory Environment?

This is the tricky part. OSFI came out with a statement a few days ago saying they were "tightening supervisory expectations for mortgage underwriting". They focused on perceived risks such as:

- high levels of overall indebtedness

- low interest rates

- rapid price increase in some areas

The letter was sent to mortgage lenders reminding them to use "prudent underwriting practices" and "sound risk management", reminded them that historic low interest rates may not last forever, to make sure they confirm income reasonability even when borrowers have more than 35% down payments, and that income should be calculated conservatively for debt servicing purposes. Last but not least they called into question the practice of relying on appraisals because lenders should "not assume that housing prices will remain stable or continue to rise."

What Does This Mean for Albertans?

It means that the current environment for careful home buyers is very good but it could get tougher to qualify for a mortgage soon. In fact, it already has. Lenders have been taking a closer look at self-employment income, seeing lower appraised values than expected, and been much more cautious about lending in smaller markets outside the major centres. It's hard work to get mortgages approved these days even for excellent borrowers.

Why it's Good

- Interest rates are great

- There's lots of inventory to choose from when buying a home

- Service providers like Realtors, mortgage brokers, lawyers and home inspectors have more time to really take good care of you

- Prices are flat or lower year over year

- Housing affordability in Alberta is excellent especially in Edmonton, where RBC reports that it's still cheaper to own a home than the 20 year average. (PDF)

- About 55% of your mortgage payment goes to principal in the first year of a new mortgage amortized over 25 years. If you don't believe me, then try our mortgage calculators. It sure beats renting.

Why it Might Get Harder to Qualify Soon

- OSFI changes mean lenders are going to be nervous underwriters

- Media pressure means lenders are going to be nervous underwriters (I did that on purpose)

- Fallout from potential slowdowns in Tortonto and Vancouver. If it hits the fan out there then we'll be caught in the cross-spray

- Continued economic sluggishness from cyclical resource prices and government policy

What Should You Do?

Well, that depends on your situation. If you're thinking about waiting to see if prices fall back I'd suggest that, in Alberta at least, they've had plenty of opportunity to do so and just stayed flat. If prices in Edmonton and Calgary can be as flat as this after one of the worst economic downturns in our history then that tells you something.

As the saying goes - buy low and sell high. If I was writing about Vancouver or Toronto my advice might be to take some profit. In Edmonton and Calgary I think it's time to get in the game. Let us know if you want to talk.

President of First Foundation Residential Mortgages and First Foundation Insurance. Live in Edmonton but cheer for the Riders. I have lots of kids. Follow me on Twitter @gordmccallum