Analysis: Bank of Canada Raises Overnight Rate, July 2018

BOC Raises Rates (And May Not Be Done Yet. Or Are They?)

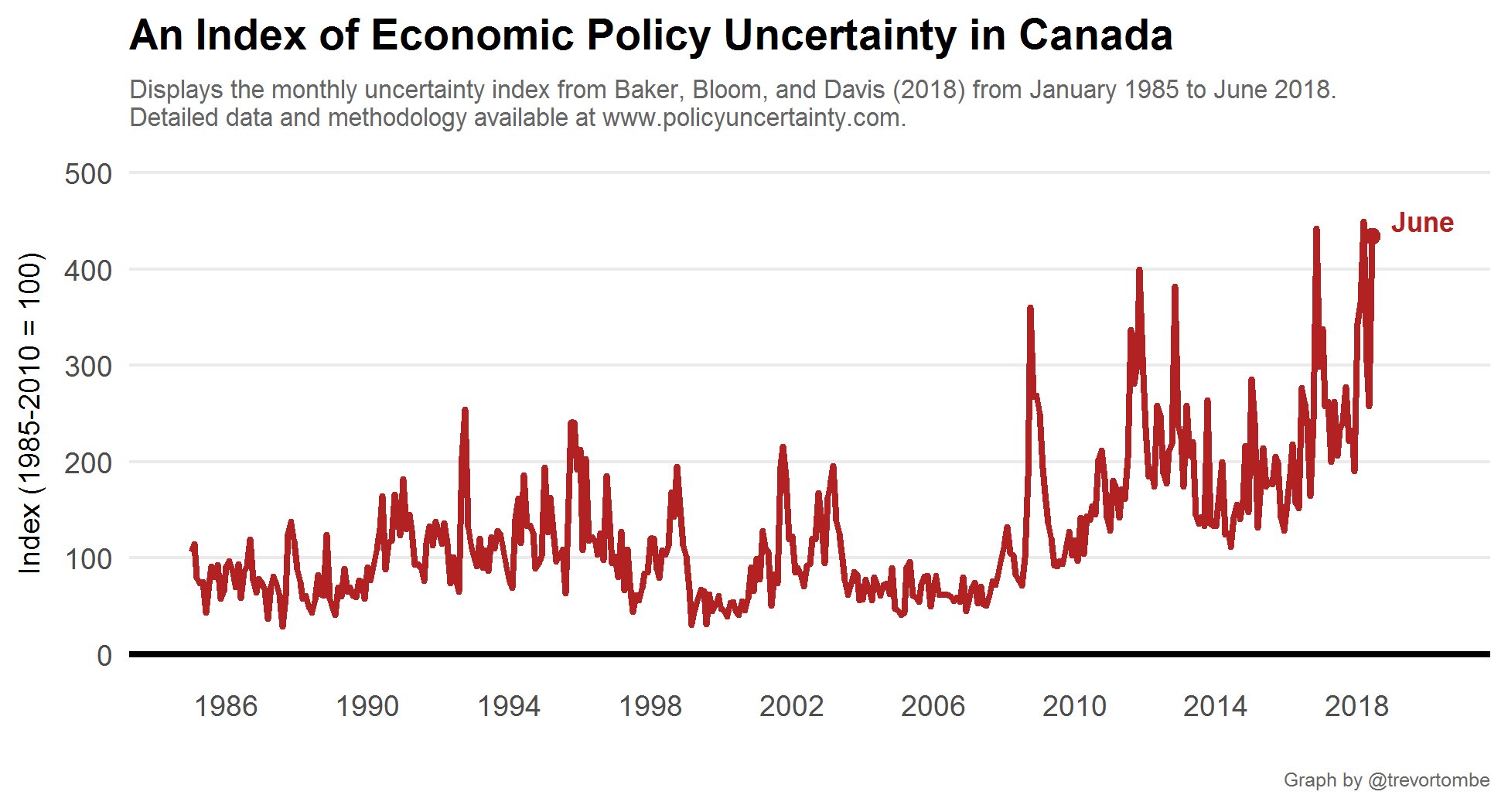

As widely expected, and widely reported, the Bank of Canada announced today that it has increased its overnight rate to 1.5%. This may be one of the more contentious rate changes that I can remember in some time, especially given the current rate of economic policy uncertainty (see chart below).

Factors Justifying a Rate Hike

If you read press releases like you read the ingredients list on a jar of food, you know that the dominant ingredient or reasoning is listed at the top. The stuff at the bottom is usually found in pretty trace quantitities but adds a bit of filler (like cellulose in parmesan cheese). So what does that tell us about Governor Poloz's rationale for rationale for raising rates this time around? Here's the list in priority sequence:

- The global economy is doing very well and growing,

- The United States economy is roaring. Really Roaring. Bigly. Much bigger than expected. Huge.

- As a result, the US Dollar is high (and, subsequently, ours is low)

- The Canadian economy is "operating at near capacity" (tell that to Alberta and Saskatchewan that remember what "near capacity" feels like)

- Exports are high because commodity prices are up (thanks US!) and our dollar is in the toilet (booooo, we're poor!)

- Keeping inflation at or near 2% is still the magic bullet

Sounds pretty good right? But there are mixed messages in this announcement:

Factors Justifying No Rate Hike

From the very same press release there are numerous dovish points made which put could put the brakes on future rate hikes and add to the uncertainty about the Canadian economy. Here they are, in order:

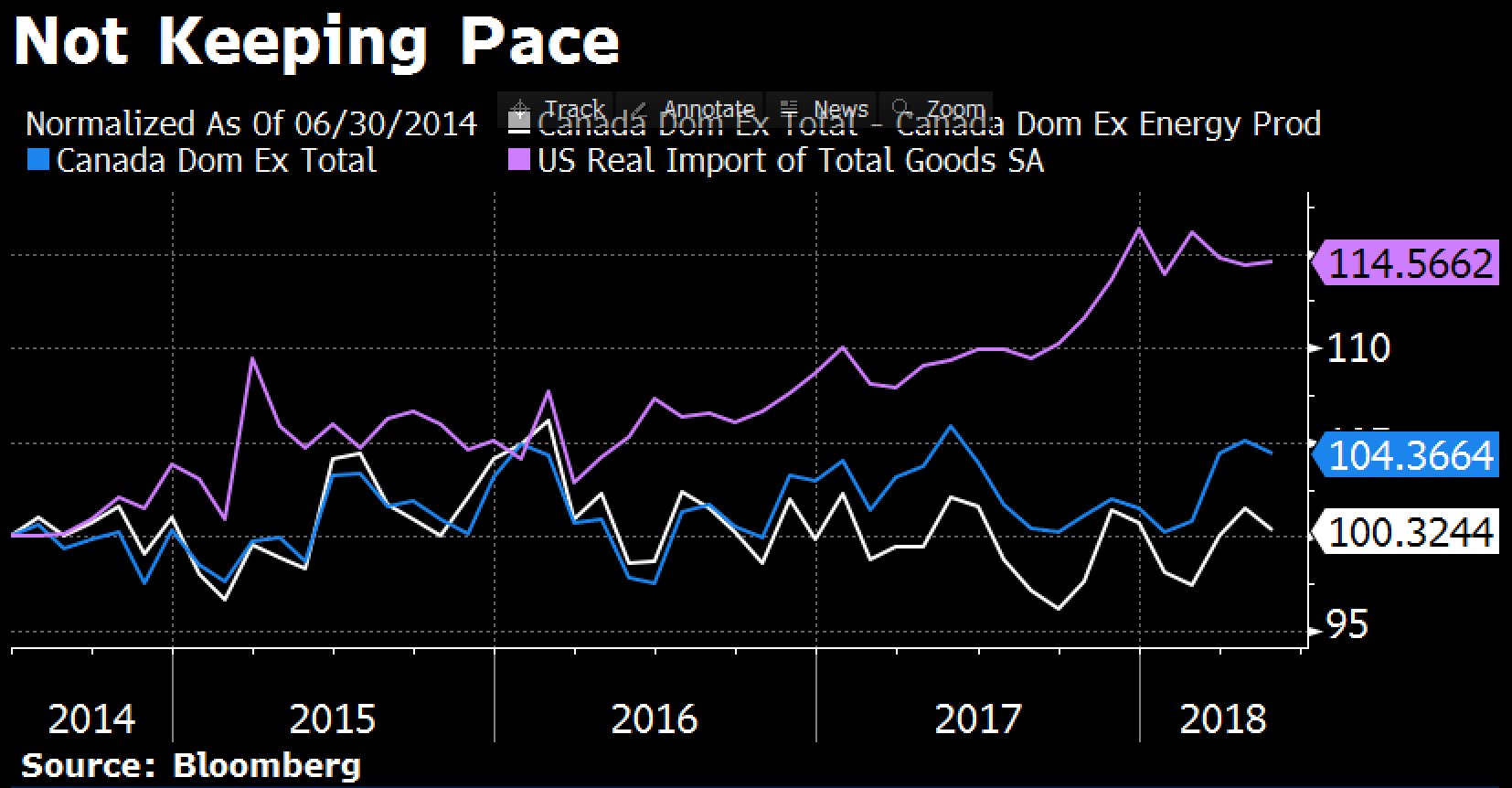

- Concerns abou trade actions. The tariffs and protectionism threats from the US are a direct threat to Canadian exports. See the graph below about how Canadian exports are already not keeping up with increased US demand (what does that say about our productivity?)

- Volatility. Next quarter 2.8%, the quarter after that 1.5%. 2% for the next 3 years forecast...with lots of volatility. This seems like an economy that is unsure about itself and whose fundamentals are wonky. Is most of the growth coming from the public sector contribution to GDP? Is that why exporters aren't keeping up with demand down south?

- Wage growth is slow, relative to an economy that is "operating near capacity".

- Household spending is down because "the" housing market sucks as a result of mortgage rule changes. (Housing markets are local...and yes, many of them suck at the moment).

- (Reading between the lines): Increasing interest rates won't help housing markets or household spending or government borrowing and spending...or business investment.

- Trade tensions.

- Trade tensions.

- Tariffs

- Trade tensions.

Decision Desk

The Bank of Canada, via Governor Stephen Poloz, has re-emphasized a high-level data-driven approach in setting monetary policy...or has he? He has also said, "Monetary policy will not react to every data fluctuation, data matters to the big picture but almost never decisive on its own," and "The bank cannot make policy on the basis of hypothetical scenarios." My questions and comments are as follows:

- These quotes seem to downplay both "data" and "hypothetical scenarios". What are left with to make decisions then?

- It seems to me that this press release and policy decision is almost entirely dressed up as a reaction to a) The strength of the US economy and dollar and b) Window dressing about the Canadian economy which is kinda sorta maybe doing ok but also might do really well or really poorly in the near / mid-term / long-term future.

- Every time I read Mr. Poloz' comments I get the sense that he's making it up as he goes. I get the impression that economists and financial reporters feel the same way. It seems as though the communication and expectation setting has been less than clear in the past.

- I also get the distinct impression that the Governor's independence is less than complete, and that political interference with the Bank is high. I believe that the present federal government has political gains to make by devaluing the Canadian dollar in order to increase exports in certain parts of the country, and the Bank seems to be playing along.

- I don't believe that Canadian economic fundamentals justify a fourth rate increase over the course of the past year, but that we're playing catch-up with the US and we had to do it. The rest of the ingredients in the press release are just filler.

The Real Reason The Bank of Canada Raised Rates

A year ago this is where rates were: 1.25% for the US and 0.75% for Canada. Canada was already lagging. Now the US target rate is 2% and Canada was at 1.25%. The BOC had no choice but to increase or risk making Canada an even less attractive place to invest than it already is, given the economic uncertainty we're facing, the dubious investment climate for large projects like pipelines, the increasing tax disadvantages to corps and high earners, etc.

How The Bank of Canada's Rate Increase Will Affect Canadian Mortgages

- Naturally, the Prime rate at Canadian banks will increase accordingly to 3.7%. It'll be interesting to see, as rates go up, whether or not Canadian banks will ever hold the line on a Prime rate increase, the same way that they failed to pass on a decrease in Prime a couple of times when the BOC was lowering. Time will tell, but I doubt it. We may see bigger discounts on ARM / Variable mortgages instead.

- Bond yields on shorter-terms (1-5 years) have been increasing timidly, but not as quickly as I had expected given the forecast of a higher BOC rate. In fact, in recent weeks fixed-rate mortgage rates and 5 year bond yields had been going downward. This is another symptom of the uncertainty facing the Canadian economy. Recently there has been more chatter about a possible bond yield inversion, which is when long-term debt ends up yielding lower than short-term debt of a similar quality. According to Investopedia, an inverted yield-curve can be a predictor of a recession.

- Canadian borrowers will pay more. Not a lot more, but a bit more. It may be temporary. If the uncertainty and rate increases trigger another recession, then we may see rates come back down.

Time will tell if this recent change will be positive for the Canadian economy or not, but it appears as though the Bank of Canada felt it had no choice, gritted its proverbial teeth, and went ahead, hoping.

President of First Foundation Residential Mortgages and First Foundation Insurance. Live in Edmonton but cheer for the Riders. I have lots of kids. Follow me on Twitter @gordmccallum