Do You Have a Financial Plan?

Gain the Confidence You Need...

Get a Plan from a Certified Financial Professional!

Financial Planning For Albertans

Let's face it: No one likes to feel stupid - especially when it comes to their money.

While the building blocks of a solid financial plan are easy to find online, if you don't have the time or interest to put them together in a way that applies to you, where do you go for financial advice?

Have you ever gone into your bank looking for help making (and sticking to) a budget and walked away with a regular contribution to your RRSP and a new line of credit instead? That is because bank employees are tasked with selling you financial products, not giving you financial advice. Sure, they can give you some pointers, but individualized advice on how to pay down debt, reduce fees, and spend your money in a way that will help you meet your goals as quickly as possible doesn't make the bank money, so their business model is designed to try sell you a product, whether you really need it or not.

Schedule an Appointment With a CFP

Start Your Own Financial Plan Online

What is Financial Planning?

Financial planning is more than just budgeting. Not only do you need to manage your day to day income and expenses, but having a short, medium, and long-term plan to is a must. A Certified Financial Planner is someone who will help you responsibly manage your own money, make investment and insurance decisions for yourself and your family, and help you to achieve your goals. First Foundation's financial planning services are just one more way that we help our clients Own, Grow, and Protect.

What is a Financial Planner?

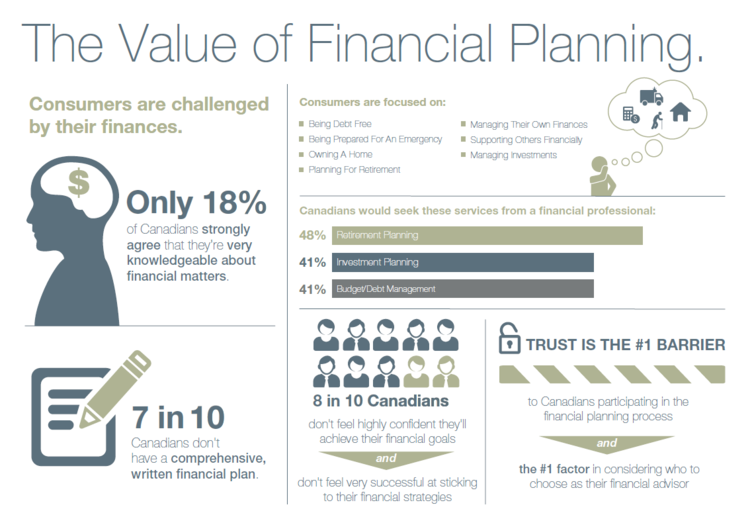

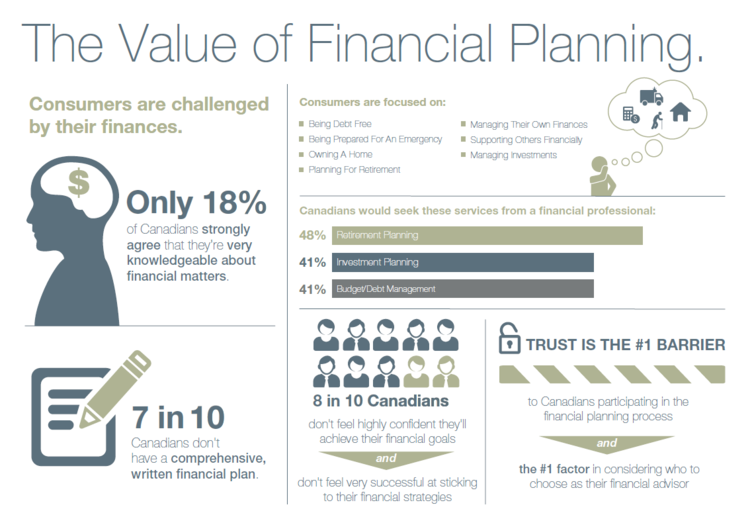

The Value of Financial Planning

Tyler Pfeiffer, CFP, CIM - Fee Based Financial Planner and Investment Advisor

First Foundation clients are able to lean on Tyler Pfieffer; a Certified Financial Planner, Investment Advisor, and licensed Life Insurance Advisor, for expert advice. If you choose, Tyler will tailor a custom financial plan for you and your family for a fee with no obligation to invest whatsoever. If you do need a budget, cashflow plan, retirement plan or succession advice, our team can prepare the right plan for you, with no strings attached.

Beyond the plan, if you do want to know more about your investment options or life, disability, and critical illness coverage then First Foundation would be happy to arrange these for you. For your company, Group Benefits Plans and customized Health Spending Accounts are available as well.

Aligned Capital Partners Inc. (“ACPI”) is a full-service investment dealer and a member of the Canadian Investor Protection Fund (“CIPF”) and Investment Industry Regulatory Organization of Canada (“IIROC”). Investment services are provided through First Foundation Wealth Management, an approved trade name of ACPI. Only investment-related products and services are offered through ACPI/First Foundation Wealth Management and covered by the CIPF. Financial Planning and Life Insurance services are provided through First Foundation Financial Inc.. First Foundation Financial Inc. is an independent company separate and distinct from ACPI/First Foundation Wealth Management.