Financial Planning Services

Serving Clients in Alberta and British Columbia

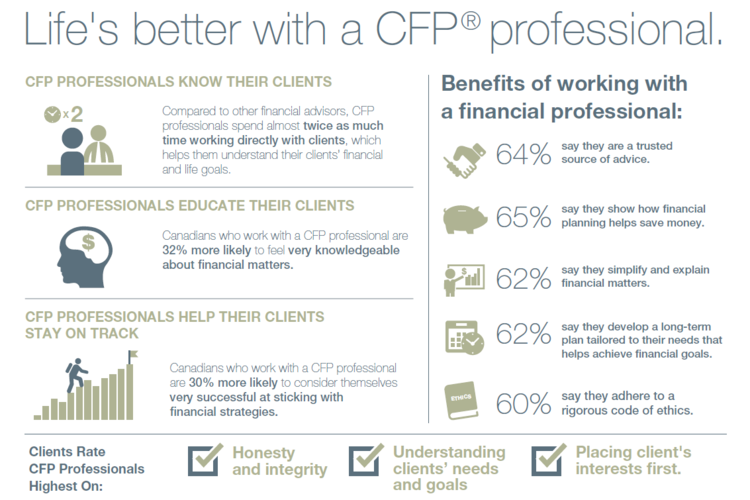

First Foundation is pleased to offer financial planning services to our clients! When you work with us, you'll work with a Certified Financial Planner and Certified Investment Manager.

Start Your Financial Plan Online >> (opens external link, but it's ok!)

Financial Planning and Investment Management for Albertans

Growth. Isn’t that the goal when it comes to your investments? How are you supposed to retire if you aren’t able to grow your wealth? How are you supposed to retire if you don’t have a plan?

“Only one in three Canadians expecting to retire in 2030 are saving at levels required to meet basic household expenses in their retirement..."

and many may need to sharply increase their annual savings or continue working past age 65 to avoid financial hardship, according to a study sponsored by the Canadian Institute of Actuaries.” (Canadian Institute of Actuaries, June 2007)

If you’re like most, the idea of knowing where to start when it comes to a comprehensive financial plan can be overwhelming. Do you understanding the difference between GICs, RRSPs, and TFSAs? When will you be able to retire? Will your kids pursue a post-secondary education? Will your parents be able to afford their own retirement? What would happen to your loved ones in the event of your death?

Because there are so many things to consider and even more things to know, these important questions often get ignored or put on the backburner, which obviously doesn’t help matters.

Let the team at First Foundation point you in the right direction to get your questions answered and a plan in place with a trusted financial advisor. Our financial advisors will help you to grow your wealth, whether you’re a seasoned investor looking to expand your portfolio or you’re just really interested in getting yourself on track for future with a comprehensive financial plan.

Schedule an Appointment With a CFP

Start Your Own Financial Plan Online

A Comprehensive Financial Plan May Include:

- Investment Management

- Retirement Planning

- Education Planning

- Life Insurance, Disability Insurance, and Critical Illness Insurance

- Estate Planning

- Fee-based financial planning

At First Foundation, we believe that a carefully thought out and professionally prepared financial strategy is a must! Because financial and estate planning are important parts of every individual’s financial well-being, we highly recommend that you work with a professional to provide to help ensure a secure and successful future for you and your family.

A Complete Suite of Financial Products Should Include:

- Many different investment options, such as, GICs, ETFs, Index Funds, Segregated Funds, and Exempt Market investments

- Many different investment account options, such as TFSA, RRSP, RESP, RDSP and high-interest banking accounts

- Related services such as mortgages, general insurance, group benefits, Health Spending Accounts, and more

- Self-service options such as financial calculators, online life insurance quotes, and the ability to do your own financial planning online

- Most importantly, great financial advice!

First Foundation Financial offers all of the above, and more!

In 2010, the Canadian Institute of Actuaries conducted a study that found:

• 72 percent of pre-retirees are concerned about “Maintaining a reasonable standard of living for the rest of their life.”

• 62 percent of pre-retirees are concerned about “Having enough money to pay for adequate health care.”

• 62 percent of pre-retirees are concerned about “Depleting all of my savings.”

• Only 35 percent of pre-retirees have consulted a financial advisor.

Don't wait another day to get started on your financial future! Contact us today to discuss your personal finance needs!

Aligned Capital Partners Inc. (“ACPI”) is a full-service investment dealer and a member of the Canadian Investor Protection Fund (“CIPF”) and Investment Industry Regulatory Organization of Canada (“IIROC”). Investment services are provided through First Foundation Wealth Management, an approved trade name of ACPI. Only investment-related products and services are offered through ACPI/First Foundation Wealth Management and covered by the CIPF. Financial Planning and Life Insurance services are provided through First Foundation Financial Inc.. First Foundation Financial Inc. is an independent company separate and distinct from ACPI/First Foundation Wealth Management.